Digital-First Strategy Key to ₦40.7tn Target, Says NRS Boss

By Momodu Favour

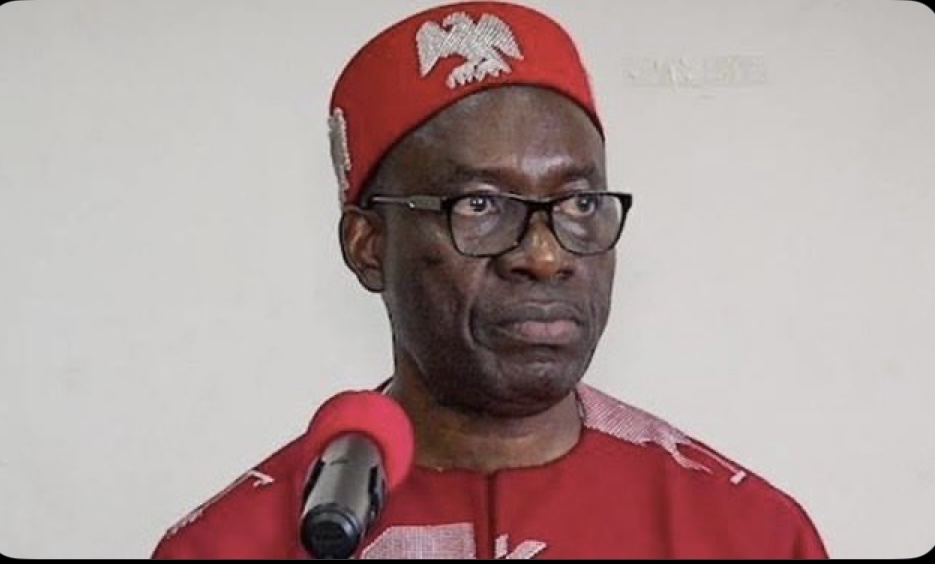

The Executive Chairman of the Nigeria Revenue Service, Zacch Adedeji, has declared that Nigeria’s ambitious tax reform agenda can only succeed through a fully automated, digital and data-driven revenue system.

Speaking in Abuja on Monday at a forum themed “Harmonising Revenue Systems and Implementing New Tax Laws,” organised by the FCT-Internal Revenue Service, Adedeji stressed that the era of manual, paper-based tax administration must give way to what he described as “tax intelligence.”

The 2025 Tax Reform Acts, which took effect on January 1, 2026, he said, provide the legal foundation for a fairer and more efficient fiscal framework.

However, he warned that without digital integration, the reforms would fall short of expectations.

Adedeji noted that Nigeria’s ₦40.71 trillion revenue projection for 2026 can be achieved without increasing tax rates — but only if tax authorities leverage automation, integrated databases and analytics-driven compliance systems.

Represented by the Executive Secretary of the Joint Tax Board, Olusegun Adesokan, the NRS boss described the engagement as timely and strategic, reflecting Nigeria’s evolving fiscal landscape and the collective responsibility of stakeholders to deliver sustainable reform.

He explained that the ongoing fiscal and tax reforms initiated by President Bola Tinubu are designed to reposition Nigeria’s domestic revenue architecture and reduce reliance on oil earnings.

However, Adedeji emphasised that legislative backing alone would not guarantee success.

“Their ultimate success rests not merely on legislative enactments, but on effective implementation, particularly at the sub-national level, where policy translates into real interaction with citizens and businesses,” he stated.

He warned against fragmented execution, saying disjointed revenue systems, multiple taxation, informal collection methods, illegal roadblocks, and indiscriminate sale of stickers and emblems undermine compliance and increase the cost of doing business.

“Such practices are inconsistent with the standards expected of a 21st-century capital city,” he added, urging the Federal Capital Territory to lead by example in transparency and modern governance.

Adedeji called for a coordinated framework among the FCT Administration, the FCT-IRS and Area Councils, advocating shared data systems, clear delineation of responsibilities, and uniform compliance protocols to eliminate duplication and improve taxpayer experience.

Highlighting the critical role of technology, he declared: “Modern tax systems are digital. They are data-driven and automated. Integrated taxpayer databases, electronic payment platforms, real-time reporting, and analytics-based compliance monitoring are no longer optional. They are foundational to effective fiscal governance.”

He maintained that sustainable revenue growth is not about imposing higher charges but about strengthening systems, improving compliance and plugging leakages.

With implementation of the new tax laws now underway, stakeholders say Nigeria’s ability to harness digital tools and ensure policy coordination across all tiers of government will determine whether the reforms deliver the projected fiscal transformation.