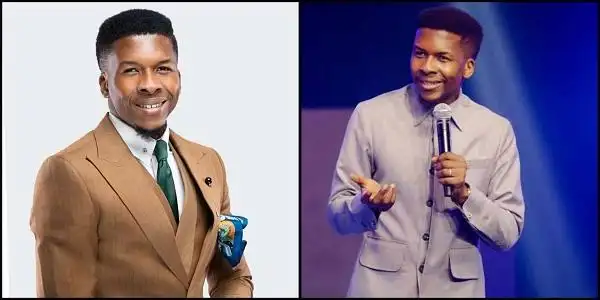

Every Individual Must File Tax Returns by March 31, Insists Oyedele

Every Individual Must File Tax Returns by March 31, Insists Oyedele

Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has reminded Nigerians to file their annual tax returns before the March 31 deadline. Speaking at a webinar for financial and HR stakeholders, he emphasized that compliance is a legal requirement. The session, held with the Joint Revenue Board, aimed to sensitize citizens on their fiscal responsibilities.

Oyedele highlighted a major gap in tax compliance, noting that while employers often file, individual self-assessments remain low. He urged those who haven’t filed to act immediately as the deadline approaches.

He stressed that both employers and individuals must adhere to the law to ensure proper fiscal documentation for the current cycle.

Addressing employers specifically, he reminded them to file returns for their staff, including salary projections. He stated, “In terms of filing returns, you need to file annual returns as employers for your employees. Many of you must have done that already. If you haven’t, you have just a couple of days left to file those returns, including projections of how much you will pay your staff.”

The Chairman corrected the misconception that salary deductions exempt employees from personal filing. He clarified that even under PAYE systems, individuals must submit personal self-assessments. He lamented that many workers wrongly assume their obligations end once their employer deducts tax, leading to widespread non-compliance across the country.

Regarding the current compliance statistics, Oyedele provided a stark assessment of the situation. He remarked, “This is one area where we have been non-compliant in Nigeria. In many states, more than 90% even the most sophisticated states cannot boast of 5% filing returns.” This highlights a significant disparity between the taxable population and those fulfilling their duties.

To improve participation, Oyedele assured the public that authorities are simplifying the filing process. He noted that State Internal Revenue Services are working to make the system more user-friendly for everyone. He reiterated that all citizens, including low-income earners, must document their previous year’s financial activities by the end of March.

Finally, Oyedele noted that businesses enjoying tax incentives must now disclose them in their filings. This new requirement under the updated tax laws aims to increase transparency and accountability. By ensuring all taxpayers disclose specific benefits, the government seeks to create a more equitable tax system for national development.