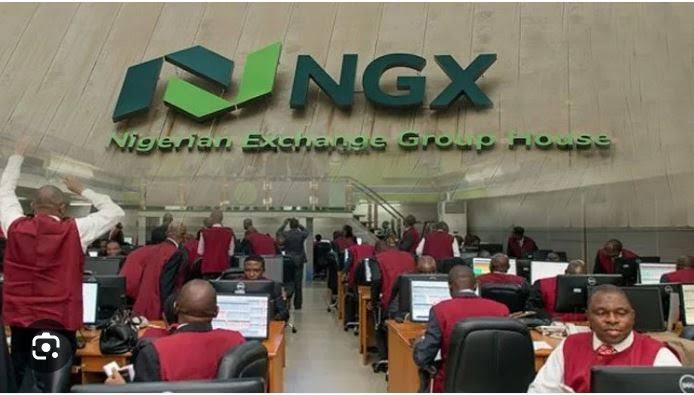

Foreign Investors Flock Back to Nigerian Equities After FX Reset

Foreign portfolio investors are steadily returning to Nigerian equities following a broad reset of the country’s foreign-exchange management framework, a shift that has restored transparency to the FX market and improved investor confidence after years of instability.

Fresh market data from the Nigerian Exchange (NGX) indicate that offshore funds have re-emerged as net buyers for the first time in three years. Between January and October 2025, foreign investors injected more than ₦1 trillion into listed equities, marking a sharp contrast to the persistent outflows that characterised the market since the height of the FX crisis.

The turnaround is closely tied to reforms introduced by the Central Bank of Nigeria (CBN), which implemented a series of measures aimed at clearing backlogs, reducing distortions, and closing the long-standing gap between the official and parallel exchange rates.

The reforms, commonly described by analysts as a “reset,” have improved price discovery and removed one of the most significant barriers to foreign participation.

According to senior CBN officials, the FX market now operates with greater clarity, while the premium between market segments has narrowed significantly compared to previous years. The bank also notes a sharp rise in foreign capital inflows, reflecting renewed global interest in Nigerian assets.

The improved sentiment has helped boost the country’s external reserves and stabilise the naira, which had suffered prolonged volatility. With more predictable currency dynamics and attractive returns across several sectors, global fund managers are gradually reallocating capital to Nigerian stocks, particularly in banking, consumer goods, and energy.

However, analysts caution that sustaining this momentum will depend on policy consistency, timely implementation of pending reforms, and effective oversight of FX intermediaries. Recent efforts by regulators to tighten the operations of bureau-de-change operators and improve transparency in currency trading are viewed as steps in the right direction, but market participants warn that any policy reversal could weaken the fragile recovery.

For now, the renewed inflow of foreign funds has lifted market liquidity and boosted valuations, offering a promising sign for issuers planning capital raising in the months ahead.

Whether these gains translate into long-term commitments—including deeper participation in corporate bonds and long-duration equity holdings—will depend largely on Nigeria’s macroeconomic stability and reform trajectory going forward.