Delayed Fuel Subsidy Removal Cause of Nigeria’s Economic Problems, Opines Emir Sanusi

Former Central Bank of Nigeria (CBN) Governor and Emir of Kano, Sanusi Lamido Sanusi, has said Nigeria’s present economic difficulties stem from the nation’s failure to eliminate fuel subsidies over a decade ago.

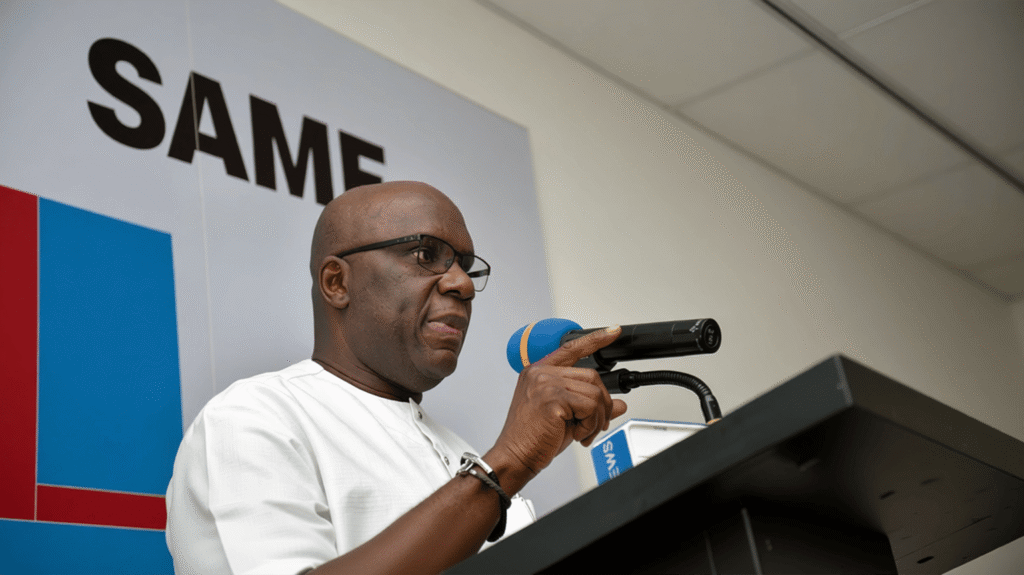

Speaking at the Oxford Global Think Tank Leadership Conference held on Tuesday in Abuja, Sanusi described the fuel subsidy system as a “dangerous financial arrangement”, arguing that it was less a subsidy and more an open-ended hedge that exposed the federal government to unmanageable fiscal risks.

“The government told 200 million Nigerians that fuel prices would remain fixed regardless of global oil prices or exchange rate fluctuations. When oil rose from $40 to $140, or when the naira weakened from ₦155 to ₦300, the government covered the difference,” he said. “That was not a subsidy—it was the worst kind of derivative.”

Sanusi explained that this approach created a fiscal trap, forcing the government to borrow heavily — not only to finance the subsidy but also to service the interest on loans used to sustain it.

“At some point, Nigeria was borrowing to pay the subsidy and then borrowing again to pay interest on those loans. That was bankruptcy by policy,” he declared.

The former apex bank chief, who led the CBN from 2009 to 2014, recalled warning the government in 2012 that postponing subsidy removal would worsen inflation and threaten long-term economic stability.

“If it had been removed then, inflation would have risen moderately from 11% to around 13% before stabilizing. Today, we are dealing with inflation above 30%. This is the cost of delay,” he noted.

Sanusi blamed Nigeria’s fiscal troubles on poor economic decision-making, saying short-term political interests often take precedence over sound economic principles. This, he said, has created unrealistic expectations among citizens regarding the roles of the CBN and the Ministry of Finance.

“Many Nigerians believe these institutions can manufacture prosperity. They cannot. Their responsibility is to ensure stability and predictability — the foundation for investment and growth,” he emphasized.

Turning to the present CBN leadership, Sanusi commended Governor Olayemi Cardoso for restoring professionalism, transparency, and monetary discipline within the institution.

“The central bank’s duty is not to generate growth or employment directly but to maintain stability and an enabling environment for such growth. I believe the current leadership is moving in the right direction,” he said.

He also praised recent CBN policy reforms targeting exchange rate stabilization, inflation control, and investor confidence, describing them as vital to correcting Nigeria’s long-standing structural imbalances.

In his concluding remarks, the Emir of Kano called for stronger coordination between fiscal and monetary authorities, urging the federal government to adopt policy consistency and fiscal discipline to prevent the recurrence of past mistakes. “Without long-term planning and accountability, Nigeria risks repeating the same fiscal errors that brought us to this point,” Sanusi warned.