Finance Minister to Set Take-Off Date for 5% Petroleum Products Surcharge

The Federal Government is set to introduce a 5% surcharge on locally produced and supplied petroleum products, with the commencement date to be determined by the Minister of Finance.

This new surcharge, provided for under the Nigeria Revenue Act, will apply to petroleum products such as petrol and diesel at the point of supply, sale, or payment whichever comes first. However, household kerosene, liquefied petroleum gas (LPG), compressed natural gas (CNG), and renewable energy sources are exempt from the levy.

According to reports, the Federal Inland Revenue Service soon to be rebranded as the Nigeria Revenue Service will be responsible for administering the surcharge on a monthly basis.

While the legislative framework has been established, implementation will only begin after the Minister of Finance issues a gazetted order specifying the effective date. This approach provides room for consultations and stakeholder engagement before rollout.

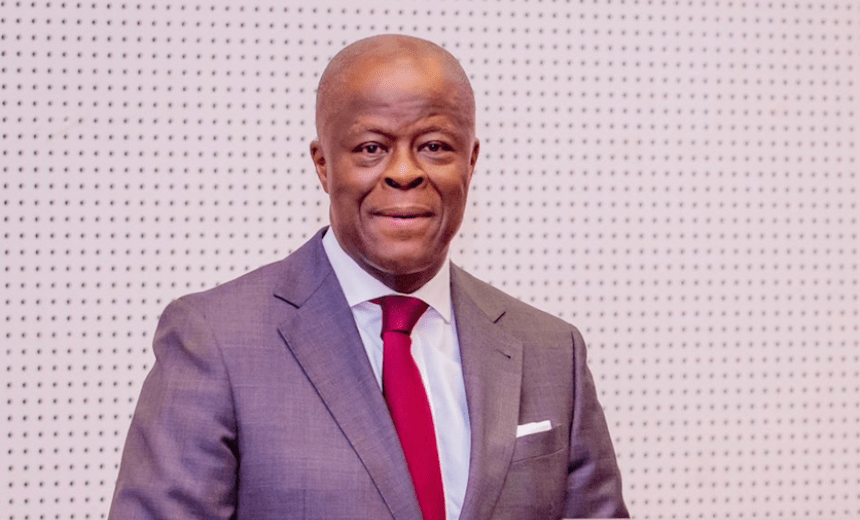

Meanwhile, stakeholders in the downstream petroleum sector, including major oil marketers, have met with Finance Minister Wale Edun to express support for the broader reforms in the industry. They commended the government’s efforts to stabilize fuel supply and promote a private-sector-led market environment following the removal of fuel subsidies.

Economic observers have noted that while the surcharge could enhance government revenue, it may also lead to a rise in pump prices, thereby increasing the cost of transportation and general goods. The government has defended the move as necessary for sustainable fiscal policy in the face of dwindling oil revenues and the need for domestic resource mobilization.

Further details on the surcharge and its implementation timeline are expected in the coming weeks following ministerial review and official announcemen