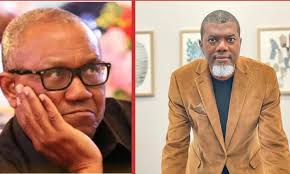

Obi’s Wrong Portrayal of Nigeria’s Debt Chasing Away Investors, Charges Omokri

Reno Omokri, a former aide to the president, has leveled accusations against Peter Obi, the 2023 presidential candidate of the Labour Party, asserting that his inaccurate portrayal of Nigeria’s debt status is discouraging foreign investors from engaging with the nation.

During his appearance on Channels Television’s “Politics Today” this past Wednesday, Mr. Omokri contended that Obi’s declarations were both deceptive and detrimental to Nigeria’s economic outlook.

Omokri noted that certain investors currently active within Nigeria are contemplating withdrawal from the market as a result of Obi’s assertions.

“That is incorrect. He does not provoke me; rather, I provoke him,” Omokri remarked during the interview. “My presence here is driven by patriotism. Peter Obi has misrepresented the truth. Foreign direct investors are tuning into your program, forming decisions not to invest in Nigeria. There are investors already in Nigeria contemplating departure due to the falsehood he propagated.

“One of the fabrications he propagated is the claim that President Tinubu has amassed greater debt compared to the administrations of Yar’Adua, Jonathan, and Buhari. This is unequivocally false.”

To substantiate his statements, Omokri cited statistics from the Debt Management Office (DMO), asserting that President Bola Tinubu has indeed lessened Nigeria’s external debt burden since assuming office.

“I possess data from the Debt Management Office, and viewers can visit DMO.com to explore the Debt Management Office, Nigeria State of Indebtedness 2015,” he stated.

“In 2015, Nigeria’s debt stood at $63 billion. Upon Buhari’s departure, the debt had escalated to $113 billion. Presently, according to the DMO, our debt has diminished from $113 billion to $97 billion, signifying that Tinubu has alleviated our debt by over $14 billion.

“We ought to be acknowledging this achievement. Yet Peter Obi appeared here and misled the Nigerian populace. He converted the debts into naira to create the illusion of increased indebtedness.”