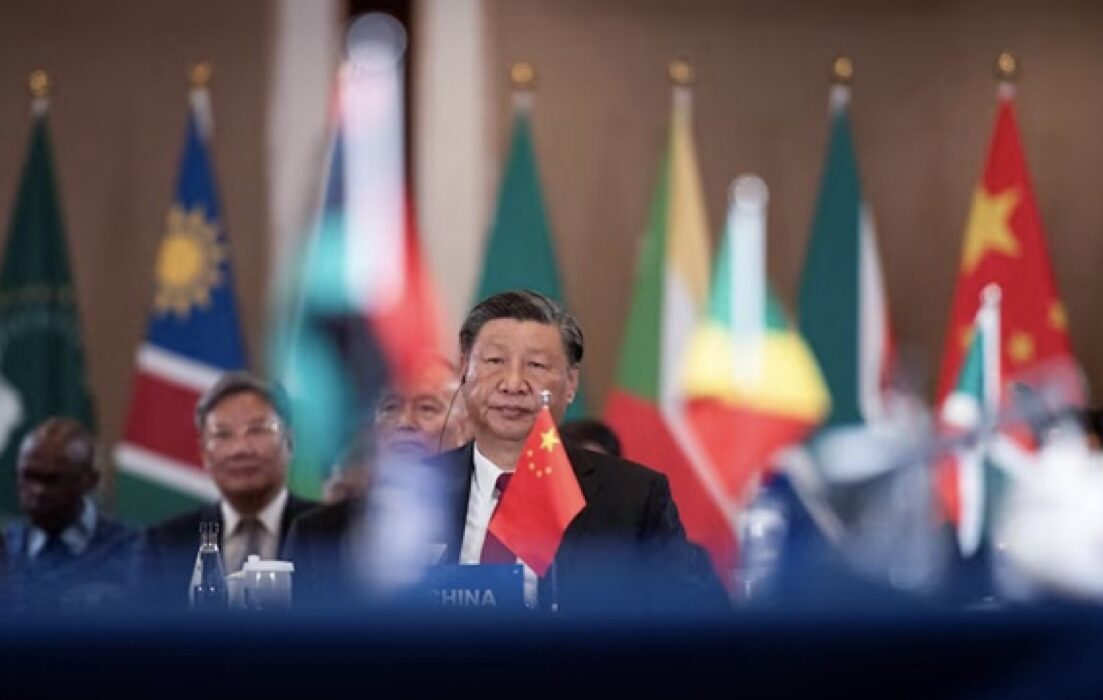

China Becomes Net Debt Collector in Africa After $52bn Financial Reversal

China has officially become a net debt collector in Africa, marking a major shift in the continent’s financial relationship with Beijing after a $52 billion swing in funding flows over the past decade, according to a new report by the ONE Data initiative.

The report reveals that African countries are now sending more money to China in debt repayments than they are receiving in new loans, reversing a long-standing trend in which China served as one of Africa’s largest development financiers. Between 2015 and 2019, the continent recorded a net inflow of roughly $30 billion in Chinese loans, largely directed toward infrastructure projects under China’s Belt and Road Initiative. However, from 2020 to 2024, this shifted into a net outflow of about $22 billion, as debt repayments surpassed new lending. This reversal reflects a sharp decline in fresh Chinese financing combined with rising repayment obligations from earlier large-scale loans. Analysts say the change signals a more cautious lending approach by China amid global economic pressures and concerns over rising debt risks in developing countries. David McNair, Executive Director of ONE Data, noted that while China’s loan disbursements to Africa have slowed significantly, repayments on past loans continue to flow outward, effectively turning China into a net recipient of funds from the continent. He warned that the trend is placing increasing pressure on African government budgets. The shift comes at a time when several African nations are already facing debt distress, including Zambia, Ghana, and Ethiopia, forcing governments to balance external repayment obligations with domestic spending on healthcare, education, and infrastructure. Economists caution that the growing debt burden could limit development progress if not managed carefully. As China scales back its lending, multilateral financial institutions such as the World Bank, the International Monetary Fund (IMF), and regional development banks have stepped in to partially fill the funding gap. The report indicates that net financing from multilateral lenders has surged by 124 percent over the past decade, now accounting for 56 percent of total net development flows, estimated at $379 billion between 2020 and 2024. Despite the short-term financial strain, some experts believe the trend could encourage greater fiscal discipline and accountability among African governments, reducing reliance on large external loans and promoting more sustainable borrowing practices. However, the report warns that the situation could worsen, as data for 2025 has not yet been fully accounted for, a year expected to reflect deeper cuts in international development assistance following reductions in Western aid and shifting global priorities.