Dangote Refinery Cuts Crude Purchases Amid Operational Setbacks, Fuel Prices May Stay High

Nigeria’s Dangote Petroleum Refinery has cut back its crude oil purchases this month after a series of operational setbacks slowed production, a development analysts warn could sustain high petrol prices and tighten local supply.

According to tanker-tracking data and cargo allocation lists cited in a Bloomberg report on Thursday, the refinery will buy fewer than 300,000 barrels of crude per day in October, less than half of its installed capacity and down over 50 per cent from its July peak of 600,000 barrels per day.

The decline in crude intake, experts say, raises concerns about the country’s fuel supply and price stability, as the Dangote facility has become central to Nigeria’s refining landscape since its operations began in 2024.

“Nigeria’s huge Dangote oil refinery has been buying a lot less crude lately amid operational setbacks, something analysts say could persist into next year and keep supporting gasoline prices,” Bloomberg reported.

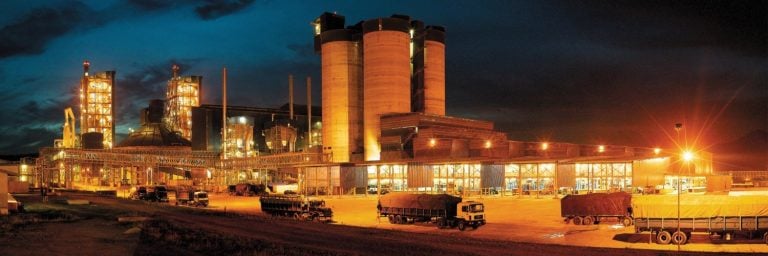

The $20 billion refinery, located in the Lekki Free Trade Zone, Lagos, has transformed fuel flows across West Africa and beyond.

However, it has battled unplanned outages, sabotage by workers, and ongoing reorganisation efforts, all of which have hampered production efficiency.

Intelligence firm, IIR Energy reported that the refinery’s gasoline unit has experienced several shutdowns this year and may need another major maintenance period early next year.

The residue fluid catalytic cracker unit, a key component of petrol production, was expected to restart this week after being offline since late August.

Refining analysts are skeptical about the plant’s ability to operate at high capacity in the near term.

“We think it is likely that Dangote will continue to face issues next year, albeit to a lesser extent than this year,” said Qilin Tam, head of refining at FGE NexantECA.

Tam warned that recurring outages could “add a bullish sentiment to the gasoline market moving forward,” particularly ahead of the next driving season.

Similarly, Sparta Commodities analyst Neil Crosby said, “European gasoline has been extremely strong as a result of Dangote’s issues. At the moment, Dangote’s track record is poor, and if that keeps going, it will be supportive for European gasoline and, to a degree, distillate going forward.”

The refinery currently receives about 1.5 million barrels of feedstock this month from the Nigerian National Petroleum Company Limited (NNPC) under a recently agreed naira-for-crude supply deal. NNPC is expected to deliver a similar volume in November, according to cargo schedules seen by Bloomberg.

Despite the agreement, traders say Dangote has yet to place new orders for West Texas Intermediate (WTI) crude for November delivery, another sign of reduced refining activity. However, the company could still make spot market purchases depending on operational needs, Crosby noted.

Energy consultancy Wood Mackenzie Ltd. projected that run rates should rebound once the refinery resolves its technical challenges.

“Any further operational issues at the refinery would curb crude runs and lead to a lower-value mix of oil products in place of gasoline,” said Alan Gelder, the firm’s vice president for refining, chemicals, and oil markets.

Gelder explained that such disruptions could push Dangote to export more fuel oil to Asia while West Africa continues importing petrol from European refiners to cover domestic shortfalls, an outcome that would benefit Europe’s refining industry.

Since beginning full-scale operations, Dangote Refinery has processed approximately 3.94 million barrels of crude per day in total, according to data reviewed by Bloomberg.

A senior executive at Dangote Industries Limited declined to comment on the refinery’s current petrol output or future operational plans.