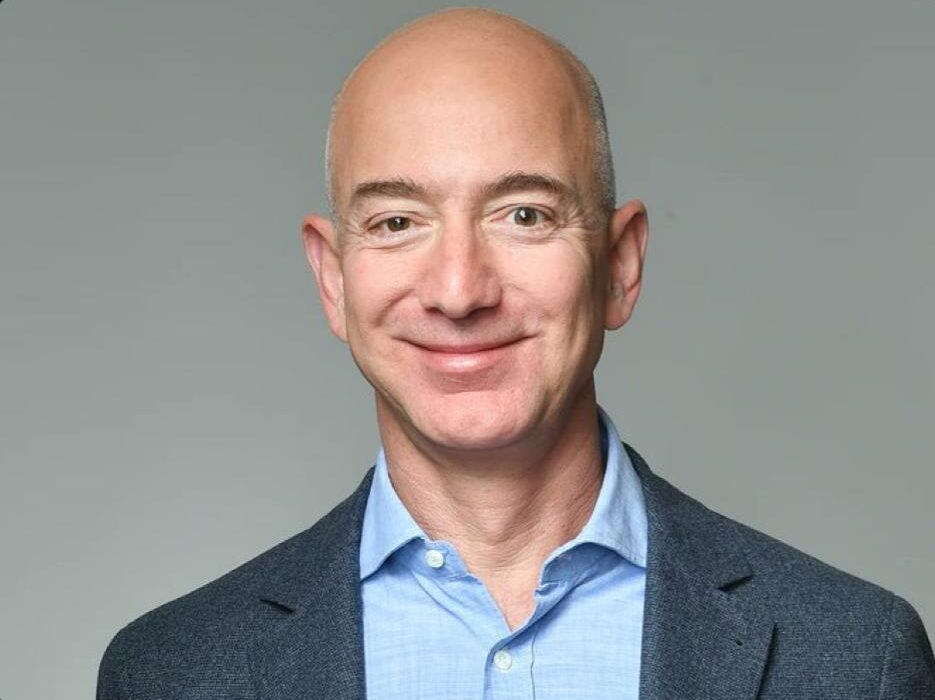

AI boom Will Reshape Global Economy Despite Bubble, Predicts Jeff Bezos

Amazon founder and executive chairman, Jeff Bezos, has predicted that the ongoing surge in artificial intelligence (AI) investment, though resembling a bubble, will ultimately transform the global economy in ways that will far outweigh the short-term risks of wealth destruction.

Speaking at the Italian Tech Week in Turin, Bezos described the current wave of AI enthusiasm as an “industrial bubble,” stressing that while many ventures may collapse, the infrastructure, skills, and innovations created in the process will deliver long-lasting economic and societal benefits. “This is kind of an industrial bubble as opposed to financial bubbles,” Bezos said. “When people get very excited, every experiment gets funded, every company gets funded.

Investors have a hard time distinguishing between the good ideas and the bad ones. This bubble will destroy wealth along the way, but the benefits to society from AI are going to be gigantic.” Drawing parallels to the dot-com boom and the rise of biotechnology in the 1990s, Bezos argued that speculative cycles can serve as accelerants for innovation. He contrasted this with purely financial bubbles, such as the 2008 financial crisis, which drained value without leaving behind useful assets. By contrast, he noted, industrial bubbles leave behind critical infrastructure and advances that continue to drive growth even after market corrections.

Bezos also offered a futuristic vision of how the rapid growth in AI could drive new technological frontiers. He floated the possibility of building gigawatt-scale data centers in space, powered by uninterrupted solar energy, as a way of meeting AI’s ever-expanding demand for computing power and cooling. “Those giant training clusters will be better built in space because we have solar power there, 24/7,” he said. While acknowledging the immense technical and financial challenges, Bezos maintained that such projects could become viable as the world grapples with AI’s energy-intensive future.

Other leaders at the event echoed concerns about the risks of overvaluation in the AI sector. Goldman Sachs CEO David Solomon warned that the current exuberance could trigger a market correction, likening the situation to the late-1990s tech bubble, even as he acknowledged the technology’s potential to enhance productivity worldwide. Market analysts have also raised alarms over the scale of today’s AI boom. Some have warned it could exceed previous speculative manias, with one recent report suggesting the AI bubble might be many times larger than the dot-com era and even the 2008 real estate crash. Prominent UK tech investor James Anderson similarly flagged “disconcerting” signs, citing rapidly inflated valuations of firms such as OpenAI and Anthropic.

Despite these warnings, Bezos’s perspective reflects cautious optimism: that AI, even if overhyped in the short term, will ultimately deliver breakthroughs in productivity and innovation across industries ranging from healthcare to logistics. For businesses, he advised investing in areas where AI can clearly improve efficiency and outcomes. For policymakers, he stressed the importance of managing both the opportunities and risks, from job displacement to soaring energy demands.

In closing, Bezos argued that history shows industrial bubbles, though disruptive, often pave the way for lasting transformation. As AI continues to expand into every sector of the economy, he suggested the world may soon look back on this moment not just as a period of speculation, but as the foundation for a new technological era.