Focus Borrowing on Growth-Oriented Projects, Prof. Ekpo Counsels Government, Prefers Alternatives to External Debt

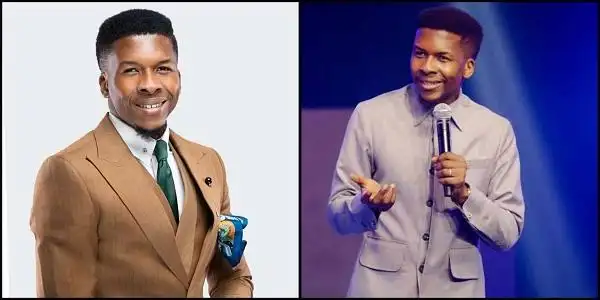

Renowned economist, Professor Akpan Hogan Ekpo, has called on the Federal Government to ensure that any borrowing undertaken is channeled strictly into projects that can stimulate economic growth and deliver measurable benefits for the nation.

He warned that accumulating debts without clear evidence of productive investments would place an undue burden on future generations.

In a recent interview, Ekpo explained that borrowing in itself is not harmful if the funds are properly managed and directed towards infrastructure and other long-term projects capable of yielding economic returns.

He stressed that what is most worrisome is when governments use loans to cover recurrent expenditure or non-productive ventures that generate no value for the economy. According to him, Nigeria must be intentional in tying loans to projects that can create jobs, boost industrialization and expand revenue sources. “When the government borrows, it must be for projects that grow the economy.

If not, the burden of repayment will fall on our children and grandchildren, and they may find nothing on the ground to justify the debts,” he said. Ekpo pointed out that Nigeria does not have to rely solely on external loans to finance development.

He explained that there are several alternative financing options that could be deployed to reduce dependence on foreign debt. These include public-private partnerships where both government and private investors share the risks and benefits of major projects, as well as contractor financing models in which contractors provide the initial capital for projects and are repaid upon completion.

He also highlighted variations such as the build-operate-transfer framework, in which private operators recover their investment over time before handing projects back to the state, and the use of tax incentives to attract private sector capital into infrastructure development. According to the economist, Nigeria already has the technical expertise to structure such arrangements effectively.

What is needed, he said, is the political will, transparency, and strong institutional frameworks to ensure that these alternative models are implemented successfully. Speaking on the current debt situation, Ekpo acknowledged that the country’s rebased Gross Domestic Product has expanded the fiscal space by lowering the debt-to-GDP ratio on paper. However, he insisted that the critical question is not how much room Nigeria has to borrow, but what the borrowed funds are used for.

He argued that loans should be focused on vital infrastructure such as power generation, which can drive industrial expansion, create employment opportunities, and strengthen long-term resilience in the economy. “If loans are used to build power plants or major transport networks in a transparent and accountable manner, they will generate the revenue and growth needed to repay them.

That is the kind of borrowing Nigeria needs,” he stressed. Ekpo’s intervention comes at a time when concerns over Nigeria’s rising debt service costs continue to dominate fiscal policy debates. He has previously cautioned that the government should use savings from fuel subsidy removal to invest in productive ventures rather than relying on continuous borrowing.

Analysts have also warned that uncontrolled borrowing risks crowding out vital spending on social services and capital projects, leaving the country vulnerable to a debt trap. The professor concluded by emphasizing that borrowing should not be demonized but must be guided by economic prudence and accountability.

He noted that the success of any borrowing program lies in transparency, careful project selection, and the assurance that loans are used to finance ventures capable of paying for themselves in the long run.

“The key is not how much we borrow, but what we borrow for,” he said.