FirstNation Faults EFCC Over Media Trial After Acquittal in N1.7bn Fraud Case

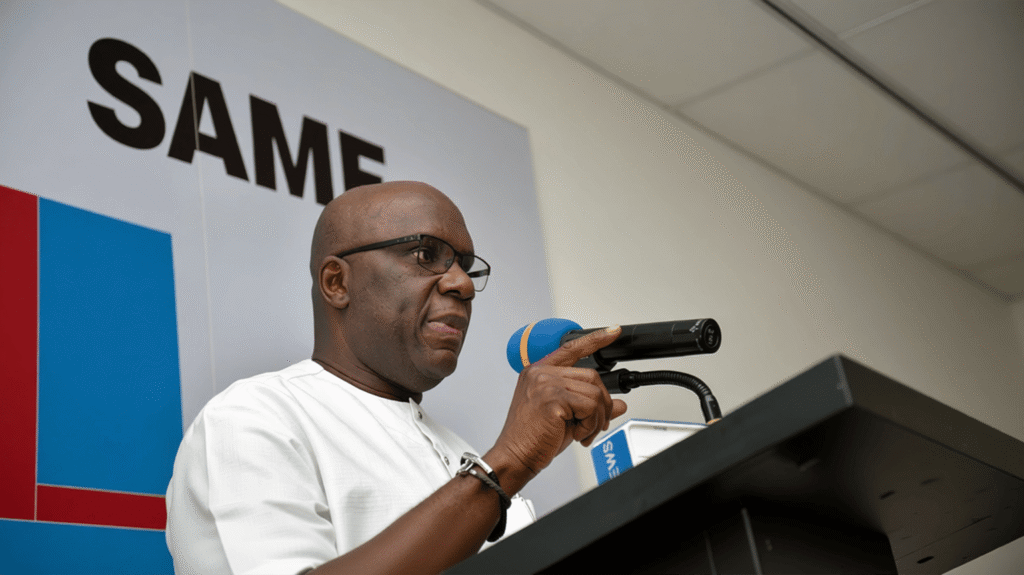

FirstNation Airways has openly criticised the Economic and Financial Crimes Commission (EFCC) for what it termed as a “media trial” that tarnished the image of the airline and its chief executive officer, Kayode Odukoya, despite their acquittal in a long-standing N1.7 billion fraud case.

The airline, in a statement, accused the anti-graft agency of deliberately failing to correct the negative public narrative it created by widely publicising the case without reflecting the December 2023 court judgment that discharged and acquitted all the defendants. It described the EFCC’s approach as unfair and damaging, insisting that the publicity surrounding the trial has left an “unjust stigma” on its operations and leadership. The case began years ago following a loan dispute between FirstNation Airways and the defunct Skye Bank, now Polaris Bank. Odukoya, along with FirstNation Airways and Bellview Airlines, was arraigned by the EFCC on a seven-count charge, including forgery, perjury, and stealing, over alleged irregularities in securing credit facilities valued at N1.7 billion. The prosecution relied heavily on documents such as a “Memorandum of Loss of Certificate of Occupancy,” which it claimed was forged. However, Justice Mojisola Dada of the Lagos Special Offences Court dismissed the EFCC’s arguments, ruling that the evidence presented lacked credibility and failed to establish any wrongdoing on the part of the defendants. After examining the submissions, the judge discharged and acquitted Odukoya and the companies in December 2023, declaring that the prosecution’s case had “collapsed like a pack of cards.” FirstNation further revealed that a joint forensic audit conducted by one of the “Big Four” international accounting firms, in collaboration with Polaris Bank, proved that the bank had overstated its loan book, exposing flaws in the allegations levelled against the airline. The company said this vindicated its position that the matter was purely commercial and should never have been subjected to criminal prosecution. According to the airline, the EFCC’s failure to promptly update the public record after the judgment has allowed a false impression to linger, impacting both its reputation and business prospects. It called on the Attorney General of the Federation, relevant regulators, and other stakeholders to address the misuse of prosecutorial powers in civil disputes, warning that criminalising commercial disagreements undermines investor confidence and economic stability. FirstNation urged authorities to introduce safeguards that would prevent regulatory overreach and ensure timely updates on concluded cases to protect individuals and organisations from prolonged reputational damage. As at the time of this report, the EFCC has not issued any official response to the criticisms, although its website still carries earlier press statements on the case. The matter has reignited discussions on the thin line between commercial litigation and criminal prosecution in Nigeria, with stakeholders stressing the need for transparency, fairness, and accountability in the country’s anti-corruption drive.