Nigeria’s Business Performance Index Climbs to 107.3 as Firms Face Financing, Policy Hurdles

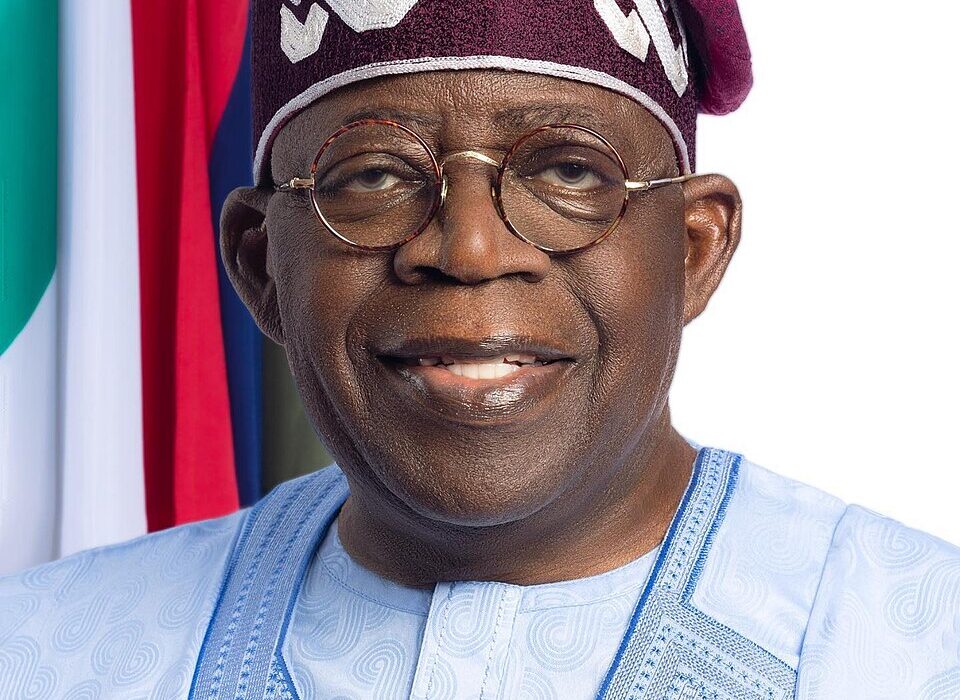

President Bola Ahmed Tinubu has declared that Nigeria has stopped borrowing from local banks, attributing the feat to improved non-oil revenue performance under his administration.

Speaking at an official engagement on Tuesday, Tinubu said his government had not only met but also exceeded its annual revenue target by August, driven largely by non-oil income sources.

“Today, I’m standing before you, I can brag that Nigeria is not borrowing a dime from a local bank. We have met our revenue target for the whole year, we met it in August —non-oil o. If the non-oil revenue is doing well, then we have no fear of whatever Trump is doing,” the President said.

Tinubu stressed that his administration’s economic reforms were beginning to yield results, noting that the reliance on crude oil earnings was gradually being replaced with stronger non-oil revenue streams such as taxes, customs duties, and other internally generated income.

The President’s remarks come at a time when Nigeria continues to grapple with foreign exchange volatility, inflationary pressures, and high living costs. Critics have often questioned the sustainability of the government’s borrowing strategy, but Tinubu insisted that fiscal discipline and improved revenue collection had put Nigeria on a stronger footing.

Observers say the achievement, if sustained, could ease pressure on the domestic credit market, reduce government crowding-out of private sector borrowing, and enhance investor confidence.

The President, however, did not give a detailed breakdown of the revenue sources or the specific measures that helped surpass the target ahead of schedule.

Economic analysts have welcomed the development but caution that the government must maintain transparency in its revenue reporting and ensure that the gains are channeled into improving infrastructure, job creation, and social welfare.