From EFCC, Police Cells to Freedom: Tinubu Broke Chains of Opaque FX Availability

By Rotimi Adewale

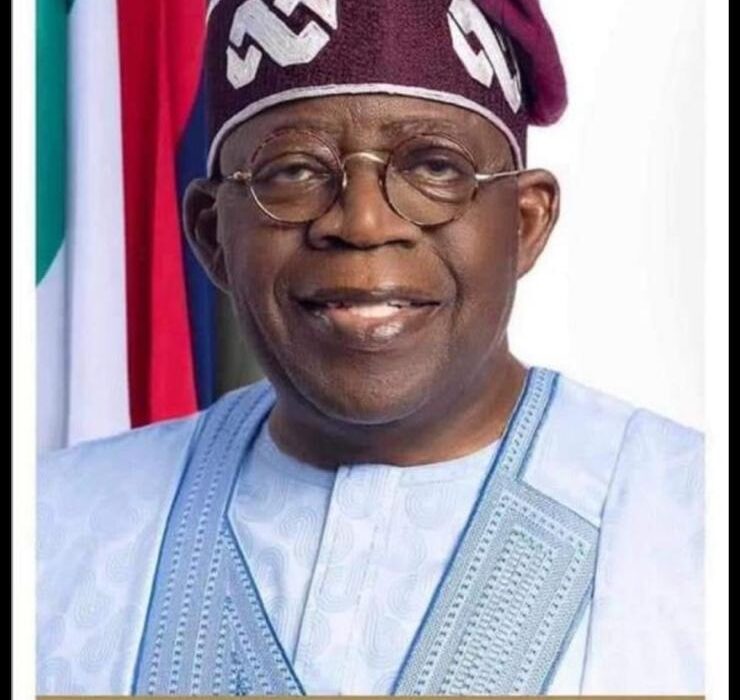

Since his inauguration in 2023, President Bola Ahmed Tinubu has embarked on bold economic reforms aimed at sanitising the hitherto erratic monetary policy Somersaults in Nigeria. Central to these is the floating and unification of the naira, a decisive break from the artificial, multiple-rate FX regime that once dictated the rules. This shift has brought palpable relief especially for FX traders and businesses who were trapped in opaque practices that bred corruption, debt, and even criminal prosecutions.

Before the reforms, Nigeria’s FX market was a dangerous place for anyone without insider access. Rates were unstable, the gap between official and parallel markets could swing by ₦300 to ₦400 in a single day, and ordinary transactions could escalate into criminal cases. Countless FX dealers, importers, and businesspeople fell into crushing debt because the naira to dollar rate changed dramatically between when a deal was agreed and when payment was made, all due to individuals fixing and influencing exchange rates on their systems. The consequences were brutal. Disputes turned into petitions, petitions turned into police or EFCC cases, and a simple transaction gone awry could mean detention, court battles, or even months in jail. It was not uncommon to visit police stations or EFCC cells and find that 70 to 80% of business-related detainees were there over FX disagreements. Trust plummeted and those with long legs and requisite connections had the day and their way.

Under the old system, businesses seeking dollars from the Central Bank of Nigeria (CBN) had to navigate skewed, unrealistic official rates often ₦500 or ₦600 per dollar while the parallel market quoted rates near ₦1,000. Access to official FX was virtually unattainable without undue influence. As Dr. Abdul Samad Rabiu, Chairman of BUA Cement, recounted: “Before now, I used to visit the CBN every two weeks to lobby for FX. That was the only way to survive.” This system bred distortions that not only crippled businesses but trapped countless FX dealers in crushing debt. Settlement was the order of the day while people became multi billionaires merely by having enough connections to have Locations as former CBN Governor and present Emir of Kano, Alhaji Sanusi Lamido Sanusi once painfully observed. As rates diverged wildly and payments lagged, many became entangled in legal battles civil and criminal often landing in EFCC or police custody in disputes that began simply due to volatile rate discrepancies.

For smaller FX dealers, the danger was even more perilous. Imagine agreeing to sell $2 million at ₦1,000 per dollar, only for the rate to spike to ₦1,300 within hours. Either the seller swallowed a huge loss, or the buyer had to pay hundreds of millions more than planned. Many chose neither and instead ran to the police, the EFCC, or the courts. In a country where law enforcement can “do beyond what they are statutorily empowered to do,” this often meant harassment, asset freezes, and prolonged detention.

From 2009 to early 2023, these scenarios played out daily. The volatility, the sharp rate differentials, and the lack of transparency meant that debt, distrust, and detention became an occupational hazard in Nigeria’s FX trade. The market rewarded lobbying and connections, not productivity or efficiency, very opaque.

On June 14, 2023, President Tinubu’s administration distraught with the unsavoury system, abandoned the multiple FX windows and allowed the naira to float freely adopting a “willing buyer, willing seller” framework. The naira initially dropped sharply, unifying the market and eliminating rationed FX access. The result was a transparent, market-driven FX system under which everyone accessed the same rate. Rabiu confirms: “Now, the rate you get is what everyone else gets. You go to the bank, you get FX at the market rate.”

This reform transcends economics, it is about restoring dignity and minimising the weaponisation of FX disputes. There is no more lobbying or favouritism. Civil and criminal cases that once sprang from simple FX disagreements have sharply reduced. The massive price gaps that triggered overnight debts are gone, and the scope for police or EFCC harassment has narrowed.

The effects are visible in business performance. BUA Cement, once battered by FX losses, has seen its post-tax profit rise to 81 billion in Q1 2025 alone, with projections of 250 billion for the year. Abdul Samad Rabiu has credited FX reforms with easing pressure on commodity prices and stabilising operations. While inflation and cost-of-living pressures remain real challenges, the FX market no longer operates as a state-sanctioned trap.

President Tinubu’s decision to float the naira and unify exchange rates did more than reshape financial mechanics, it liberated countless Nigerians from cycles of debt, fear, and institutional harassment and crested a level playing field for genuine foreign exchange needs. The reformed FX landscape served all on one plate, empowered honest commerce, and reduced the scope for arbitrary detention by police and EFCC entanglements. In rescuing the naira from artificial control, Tinubu also rescued Nigerians from a system where currency instability was weaponised against them In the court of public opinion, that is a liberation worth remembering.

Yes, Tinubu broke the chain, rescued the oppressed, set the captives free. Like the wall of Jericho that fell flat is forever remembered by the Christian faithful, so will the the Forex merchants forever cherish president Bola Ahmed Tinubu for setting them free.

Rotimi Adewale

Spokesperson, Accountability and Policy Monitoring