BUA Chairman Praises FX Reforms for Ending Dollar Lobbying Culture

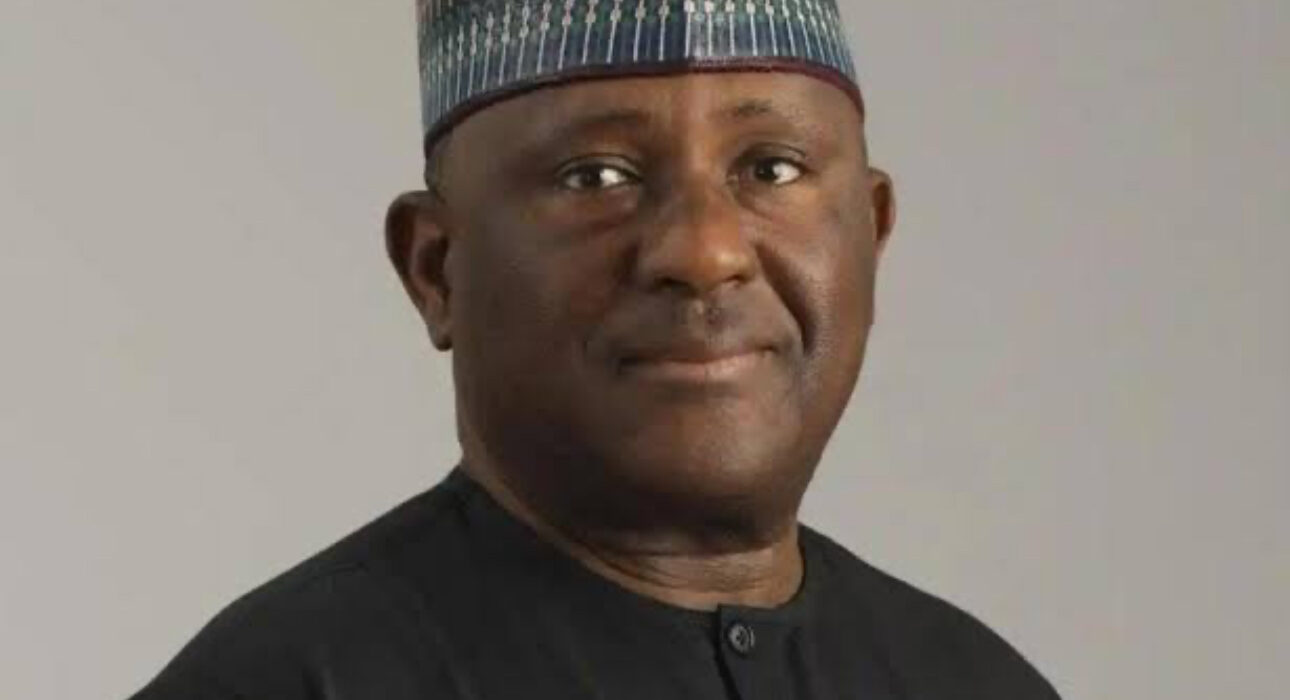

The Chairman of BUA Group, Abdulsamad Rabiu, has commended the Federal Government’s foreign exchange (FX) reforms, describing them as a critical step toward ending the long-standing culture of lobbying for dollars among Nigeria’s business and political elite.

Speaking at a recent economic forum in Abuja, Rabiu said the decision to unify Nigeria’s multiple FX windows was painful but necessary. According to him, the move has helped curb speculative practices, improved market transparency, and significantly reduced the informal influence previously wielded by individuals seeking preferential access to foreign currency.

“Before these reforms, there was a wide disparity between the official and parallel market rates. People were lobbying to get dollars at the official rate, only to turn around and sell them at higher black market rates. That encouraged manipulation and drained our economy,” Rabiu noted.

Prior to the unification, the official rate hovered around ₦500 to the dollar, while the parallel market traded at over ₦800. After the reforms were introduced by the Tinubu administration in mid-2023, the exchange rate briefly surged to nearly ₦2,000 per dollar before stabilizing at around ₦1,500 to ₦1,550.

Rabiu stressed that while the reforms triggered immediate hardship, particularly through inflation and a higher cost of doing business, they were necessary for long-term economic health. He urged Nigerians to remain patient, noting that the benefits—such as transparency, reduced rent-seeking, and enhanced investor confidence—would become clearer over time.

“We are no longer in an era where people simply make a few phone calls to access dollars. The market is becoming more structured and less prone to manipulation,” he said.

The International Monetary Fund (IMF) also recently endorsed the FX reforms, noting that they had helped narrow the gap between official and parallel rates to below 3%, improved price discovery, and boosted confidence in Nigeria’s currency market. The reforms, supported by the Central Bank of Nigeria (CBN), included ending preferential allocations, introducing the B-Match platform for rate discovery, and adopting a more flexible exchange rate regime.

As one of Nigeria’s largest industrialists, Rabiu’s support is viewed as a strong endorsement of the government’s economic direction. He encouraged fellow business leaders to adapt and support policies that promote a more stable and competitive market environment.

“The days of backdoor deals and currency arbitrage are fading. We must now build value through production, not connections,” he concluded.

The BUA chairman’s remarks echo a broader sentiment among reform-minded stakeholders that transparency and market discipline are essential if Nigeria is to overcome its long-standing structural economic challenges.