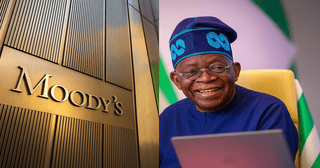

Moody’s Elevates Nigeria’s Rating to B3 in Acknowledgement of Improved Fiscal Conditions

The global credit ratings agency Moody’s has elevated Nigeria’s sovereign rating from Caa1 to B3, reflecting on substantial advancements in the nation’s external and fiscal conditions.

This upgrade denotes increasing confidence in Nigeria’s economic stability and future prospects.

Principal Drivers of the Upgrade:

– Enhanced Balance of Payments: The overhaul of Nigeria’s foreign exchange management framework has significantly improved the balance of payments and fortified the Central Bank of Nigeria’s (CBN) foreign exchange reserves.

– Alleviating Inflationary Threats: Recent economic strategies have stabilized borrowing costs and curbed price growth, notwithstanding previous policy shifts that led to inflationary pressures.

– Remarkable Economic Performance: The World Bank noted that Nigeria experienced its swiftest economic growth in nearly a decade in 2024, spurred by robust fourth-quarter expansion and improved fiscal management.

Economic Forecast:

Moody’s has revised Nigeria’s economic outlook from positive to stable, predicting ongoing enhancements in external accounts and fiscal health, albeit at a moderated pace, especially if oil prices decline. The agency anticipates that improvements in external and fiscal conditions will slow but not completely reverse.

Challenges Ahead:

Persisting inflation remains a significant concern, necessitating sustained economic policies to ensure enduring stability. Experts warn that Nigeria must maintain its economic momentum while addressing inflationary pressures.

Impact of CBN Reforms:

The CBN’s reforms, spearheaded by Governor Olayemi Cardoso, have been pivotal in stabilizing the foreign exchange market, enhancing dollar liquidity, and reinstating investor confidence. Key reforms include:

– Exchange Rate Unification: Transitioning towards a single, market-determined exchange rate regime.

– Resolution of Foreign Exchange Obligations:Tackling outstanding obligations to rebuild trust in the Nigerian market.

– Willing-Buyer, Willing-Seller Model: Encouraging greater flexibility and diminishing artificial controls in the FX market.