Dangote, NNPCL disagreement Escalate over Naira Crude Supply.

The dramatic rift between the Nigerian National Petroleum Company Limited (NNPCL) and the Dangote Refinery has sent shockwaves throughout the country’s fuel market, threatening to upend the delicate balance of power between the government, private industry, and consumers.

The collapse of the long-awaited agreement to supply crude oil to the Dangote Refinery in naira has left both sides in a tense standoff, with far-reaching implications for Nigeria’s energy sector, economic policies, and the future of the fuel economy.

At the heart of the dispute is the Federal Government’s insistence that Dangote Refinery must settle all outstanding payments and provide a letter of credit before any new supply of crude oil can be approved. This demand has been met with outrage by the Dangote Refinery team, who accuse the government of acting in bad faith and deliberately trying to sabotage their operations. The Dangote Refinery had been counting on a steady supply of crude oil from NNPCL to power its operations and produce fuel at a lower cost, which would have helped to reduce the country’s reliance on imported fuel and bring down prices for consumers.

However, with the government’s refusal to grant Dangote Refinery favorable terms, the company is now being forced to explore alternative sources of crude oil, including imports from Western countries. This move could have significant geopolitical implications, as it could reduce Nigeria’s influence over its refining operations and lead to a loss of revenue for the government. The Nigerian government has long been keen to maintain control over the country’s oil resources and has been wary of allowing private companies to gain too much power in the sector.

The Dangote Refinery’s decision to source crude oil from abroad could also put pressure on the government to reconsider its stance, as it could mean losing a major domestic buyer of Nigerian crude oil. If Dangote finds more reliable and cost-effective crude oil suppliers abroad, it could reduce Nigeria’s ability to dictate the terms of the oil trade and undermine the government’s control over the sector. This could have far-reaching consequences for the country’s energy policy and its ability to manage its oil resources effectively.

Meanwhile, the ongoing dispute between NNPCL and Dangote Refinery is having a direct impact on consumers, who are being forced to pay high prices for fuel due to the lack of competition in the market. The government’s refusal to allow Dangote Refinery to operate at full capacity has meant that NNPCL has been able to maintain its stranglehold on the market, selling imported fuel at high rates and reaping huge profits. This has left consumers stuck with expensive petrol, further exacerbating the country’s economic woes.

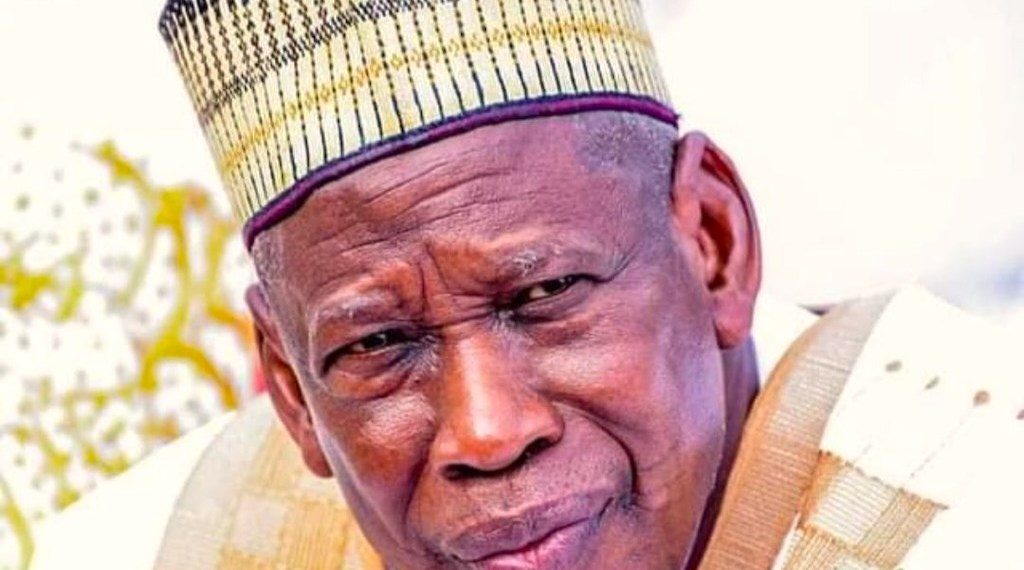

The situation remains fluid, with both sides holding firm to their positions. Dangote is pressing forward with his refinery plans, while the Federal Government seems unwilling to grant him any special concessions. The outcome of this battle will have lasting consequences for Nigeria’s energy sector, economic policies, and the power dynamics between private industry and government. If Dangote Refinery is able to successfully navigate the challenges posed by the government and secure a reliable supply of crude oil, it could mark a significant shift in the balance of power in the sector, paving the way for greater competition and lower prices for consumers.

However, if the government is able to maintain its control over the sector and prevent Dangote Refinery from operating at full capacity, it could have serious consequences for the country’s economic development and its ability to attract investment in the energy sector. The government’s actions could be seen as a sign of its unwillingness to allow private companies to play a major role in the sector, which could deter other investors and hinder the country’s ability to develop its energy resources effectively.

Ultimately, the dispute between NNPCL and Dangote Refinery is not just about crude oil supply; it is a fight for control, influence, and the future of Nigeria’s fuel economy. The outcome of this battle will have far-reaching implications for the country’s energy sector, economic policies, and the power dynamics between private industry and government. As the situation continues to unfold, Nigerians are left watching with bated breath, wondering whether it will ultimately lead to cheaper fuel or yet another disappointment in the country’s long history of fuel price struggles.

In the short term, the dispute is likely to lead to further price increases and shortages, as the lack of competition in the market allows NNPCL to maintain its dominance. However, in the long term, the outcome of the dispute could have significant implications for the country’s energy policy and its ability to develop its oil resources effectively. If Dangote Refinery is able to succeed in its plans to produce fuel at a lower cost, it could help to reduce the country’s reliance on imported fuel and bring down prices for consumers. On the other hand, if the government is able to maintain its control over the sector, it could hinder the development of the energy sector and prevent the country from realizing its full potential.

The international community is also watching the situation with interest, as the dispute has implications for the global energy market. The Dangote Refinery’s decision to source crude oil from abroad could have significant implications for the global oil trade, as it could lead to a shift in the balance of power between oil-producing and oil-consuming countries. The dispute also highlights the challenges faced by African countries in developing their energy resources and the need for effective policies and regulations to support the growth of the sector.